Cheaper Insurance for Taxi | Private Hire Car | Standard Policy | Courier | Delivery

Get in Touch via WhatsApp to Get a Quote.

What is private hire taxi insurance?

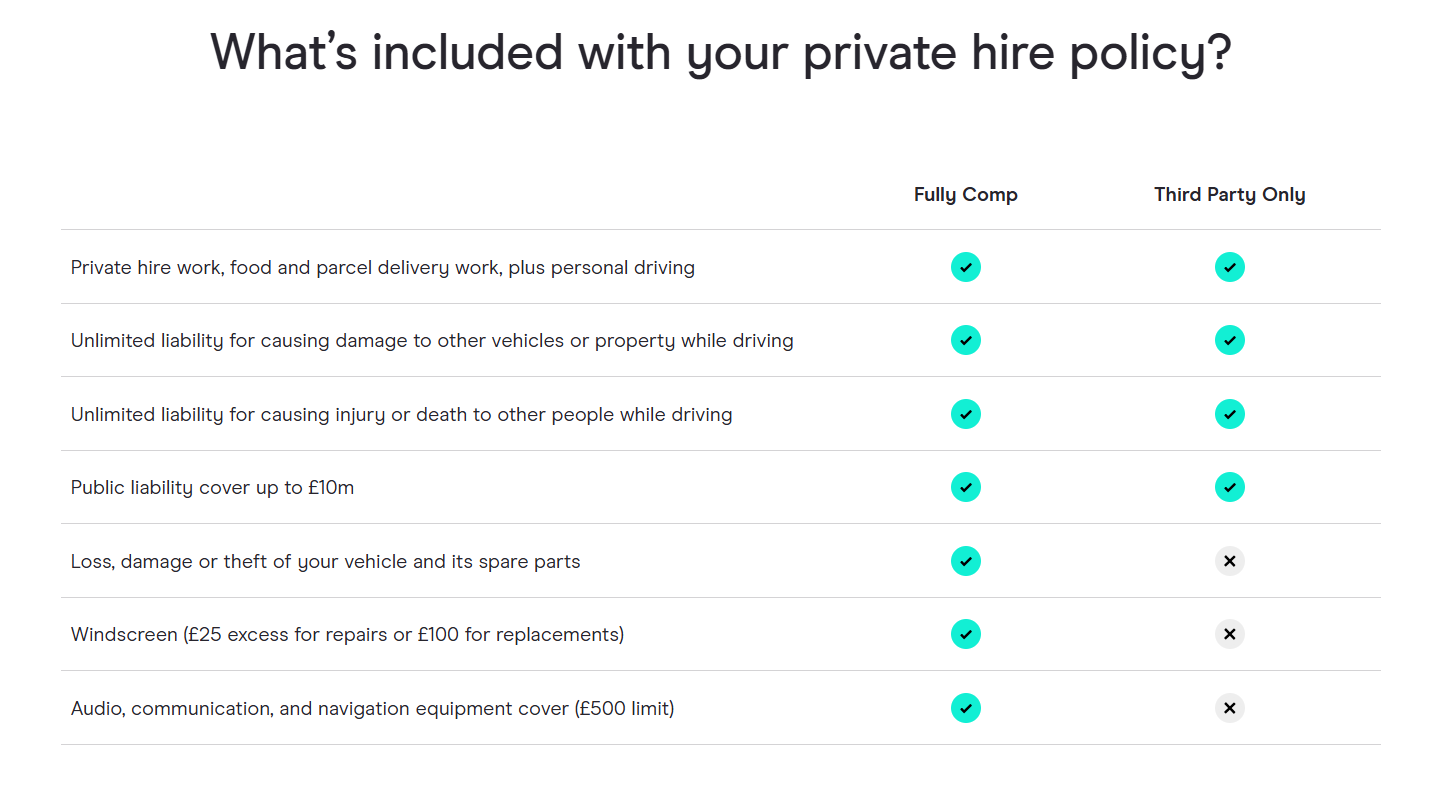

Private hire insurance is cover for taxi drivers who carry pre-booked passengers in return for payment (it’s also known as ‘hire and reward’). If you’re a taxi driver work for a ride-hailing app like Uber or Bolt, you’ll need private hire taxi insurance.

Depending on the level of insurance you choose, it can cover you and your vehicle, plus other people and their property.

Comprehensive Car Insurance

Comprehensive car insurance offers the highest level of protection. It covers damage to your own vehicle and others’ in an accident, as well as incidents involving fire, theft, and vandalism.

Additional benefits often include windscreen repair or replacement, coverage for personal belongings, and reimbursement for medical expenses. This is the most inclusive and recommended option for drivers looking for peace of mind.

Additional benefits often include windscreen repair or replacement, coverage for personal belongings, and reimbursement for medical expenses. This is the most inclusive and recommended option for drivers looking for peace of mind.

Third Party, Fire, and Theft Car Insurance

This level of car insurance provides a middle ground between comprehensive and third party only coverage. It protects you against damage caused to other people’s property or injuries to others.

Additionally, it covers your own vehicle if it is stolen or damaged by fire. While it does not include broader protections like comprehensive insurance, it is a cost-effective option for drivers who want more than the minimum legal coverage.

Additionally, it covers your own vehicle if it is stolen or damaged by fire. While it does not include broader protections like comprehensive insurance, it is a cost-effective option for drivers who want more than the minimum legal coverage.

Third Party Only Car Insurance

Third party only car insurance is the minimum level of coverage required by law. It includes compensation for damage to other people’s vehicles or property and injuries to others.

However, it does not cover your own vehicle in the event of an accident or other damage. This type of insurance is typically the cheapest but offers the least protection.

However, it does not cover your own vehicle in the event of an accident or other damage. This type of insurance is typically the cheapest but offers the least protection.